02 LOAN MANAGEMENT

With Fortune Loan Management solution, a company can keep track of all information relevant to bank loans and save valuable staff time by simplifying its tasks.

Fortune Loan Management is a state of the art integrated solution offering following functionality:

- Management of simply structured loans and complex loans such as syndicated loans. Flexible definition of Repayment Schedules either automatically based on Loan Agreement clauses or manually by the end users.

- Support of loans with multiple drawdown amounts & fixed or floating interest rates.

- Automatic calculation of Interest Expenses, Commitments Fees and other finance costs.

- Loan Valuation for Loans denominated in foreign currencies on a specific date.

- Management of payments for loan installments and support for unscheduled payments (Extra – Ordinary Payments).

- Integration with General Ledger for the preparation of loan transaction entries such as Drawdowns, Interest Expenses Amortization, Current Portion Amortization, Principal & Interest Payments.

- Customizable screens according to user responsibilities and preferences.

- Embedded Internal Chat system (Enhanced Notes) to facilitate communication among office users.

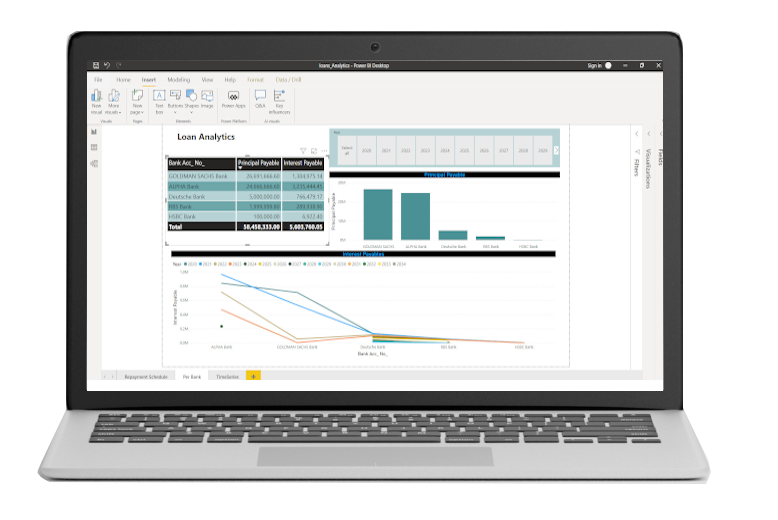

- Extensive reporting capabilities. Dynamic representation of charts according to user’s preferences, as well as generation of statistical information, graphs, calculations etc. on all data inserted.

- Central Roles & Permissions Management.

- Role Based dashboard.